The current economic downturn has created a lot of uncertainty and volatility in financial markets. Investors are looking for ways to protect their wealth and preserve their purchasing power in the face of these challenges. One of the most time-tested ways of doing so is investing in gold marketing. In this article, we’ll explore the benefits of investing in gold during an economic downturn and how it can help investors weather financial storms.

1. Safe Haven Asset

Gold is considered a safe haven asset, meaning that it’s a reliable store of value during times of economic turmoil. This is because gold has a long history of retaining its value, even during periods of high inflation or economic instability. Gold’s value is not tied to the performance of other assets like stocks, bonds, or real estate, making it an excellent diversification tool. When other asset classes are declining, gold can act as a hedge against losses, providing a measure of financial security.

Gold’s reputation as a safe haven asset has been reinforced during the COVID-19 pandemic. In the early stages of the pandemic, investors were rushing to sell off their holdings in the stock market, causing prices to plummet. At the same time, the price of gold surged, as investors sought out a reliable store of value. This trend continued throughout the pandemic, as investors remained wary of the stock market’s volatility.

2. Inflation Hedge

During periods of high inflation, the value of fiat currencies like the US dollar can decline rapidly. However, gold is known to retain its value over time, making it an excellent hedge against inflation. Historically, gold has been a popular choice for investors looking to protect their purchasing power during periods of high inflation.

The COVID-19 pandemic has also led to concerns about inflation. The massive stimulus packages that governments around the world have enacted to combat the pandemic have led to fears that inflation may surge in the coming years. By investing in gold, investors can protect their wealth and preserve their purchasing power, even in the face of inflation.

3. Limited Supply

Gold is a finite resource, and the supply is limited. Unlike fiat currencies, which can be printed at will by central banks, the amount of gold in the world is finite. This means that gold is not subject to the same inflationary pressures as fiat currencies. In fact, the limited supply of gold has helped to make it a valuable asset over the centuries, and this value is likely to persist in the future.

The limited supply of gold also makes it a valuable asset during times of economic uncertainty. When other assets like stocks or real estate are declining, the supply of gold remains constant. This means that the value of gold can rise, even as other assets are falling in value.

4. Currency Hedge

Gold is often used as a currency hedge. When the value of a particular currency declines, the value of gold tends to rise. This is because gold is a global asset that is priced in US dollars. When the value of the US dollar declines, investors flock to gold as a store of value, driving up its price. In this way, gold can help investors protect their wealth in the event of a currency crisis.

During the COVID-19 pandemic, the value of the US dollar declined significantly, as the Federal Reserve enacted massive stimulus measures to support the economy. This led to a surge in the price of gold, as investors sought out a reliable store of value.

5. Portfolio Diversification

Investing in gold can help diversify an investor’s portfolio. When an investor puts all their eggs in one basket, they expose themselves to higher risks. By investing in a range of assets, including gold, investors can spread their risk and reduce the impact of market downturns on their overall portfolio. This is because gold has a low correlation

Lastly

In times of economic uncertainty, investing in gold marketing can be an effective way to protect your wealth and diversify your portfolio. By providing a safe haven, an inflation hedge, a limited supply, a currency hedge, and portfolio diversification benefits, gold can help investors navigate through the ups and downs of financial markets.

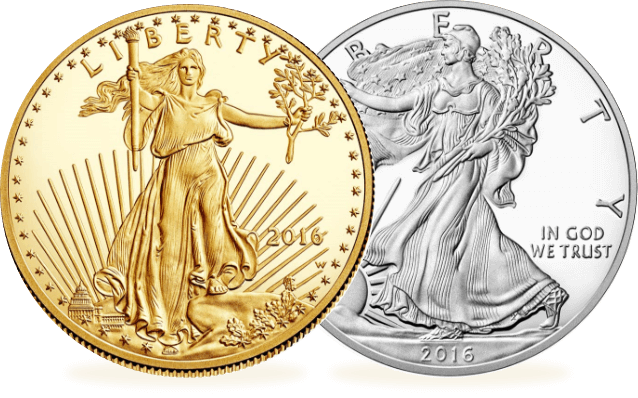

If you’re interested in investing in gold, there are several options available to you. You can purchase physical gold, such as bullion bars or coins, or invest in exchange-traded funds (ETFs) that track the price of gold. It’s important to do your research and consult with a financial advisor before making any investment decisions.

Overall, adding gold to your investment portfolio can provide a valuable source of stability and security, especially during an economic downturn. By diversifying your holdings with this precious metal, you can help protect your wealth and ride out any financial storms that may come your way.