Investing in gold and bitcoins are two popular forms of investment in the financial market. While both have their own unique benefits, it’s important to understand the advantages of investing in gold marketing and how it compares to investing in bitcoins.

Benefits of investing in gold marketing:

Diversification

Gold is a tangible asset that can help diversify your investment portfolio. Unlike stocks and bonds, gold has historically shown to have a low correlation with other asset classes, meaning that it can provide a hedge against market volatility.

Safe Haven

Gold has been used as a store of value and a safe haven for centuries. During times of economic uncertainty or geopolitical turmoil, gold tends to hold its value, making it an attractive option for investors looking to protect their wealth.

Inflation Hedge

Gold is often seen as a hedge against inflation. As the value of fiat currency decreases, the price of gold tends to rise, making it a useful tool for preserving purchasing power.

Low Maintenance

Gold is a low maintenance investment. Unlike stocks or real estate, gold does not require ongoing maintenance or management, making it a convenient choice for investors who want a hands-off approach.

Comparing gold to bitcoins:

Tangibility

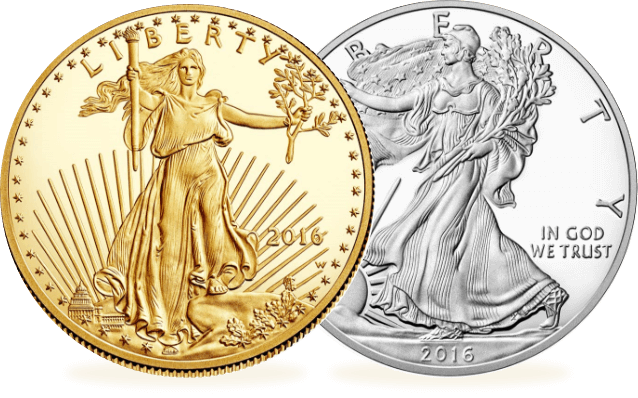

One of the biggest differences between gold and bitcoins is tangibility. Gold is a physical asset that can be held in your hand, while bitcoins are a digital currency that exists only in cyberspace.

Volatility

Bitcoins are known for their extreme volatility. While the price of gold can fluctuate, it tends to be less volatile than bitcoins, which can experience dramatic price swings in a short amount of time.

Accessibility

While gold can be purchased in the form of coins or bars, it can be difficult and expensive to store and transport. Bitcoins, on the other hand, can be bought and sold online and stored in a digital wallet, making them more accessible to a wider range of investors.

Security

While gold is physically secure and can be stored in a safe or vault, it is still vulnerable to theft or loss. Bitcoins, on the other hand, are stored in a digital wallet that can be encrypted and protected with multiple layers of security, making them less vulnerable to theft.

In conclusion

Investing in gold marketing has many benefits, including diversification, a safe haven during economic uncertainty, and a hedge against inflation. While bitcoins offer accessibility and security benefits, they are also known for their extreme volatility and lack of tangibility. Ultimately, the best investment strategy depends on your individual financial goals and risk tolerance. A well-diversified portfolio may include both gold and bitcoins as part of a broader investment strategy.