There has been a lot of notable economic crisis that has occurred in the past decades which has impacted the price of gold. From the first recession in 1929 that has priced gold at $20.63 per ounce to the 2019 pandemic that has priced gold at $1,514.75 per ounce.

Regardless of the economic crisis that has occurred in the past, gold is still an important commodity in the current global economic market today. With that being said, if you are new to gold and are looking to invest in them.

This article will be a great start as it will be an extensive all-inclusive introductory article on gold covering:

- Introduction To Gold

- Ways To Invest In Gold

- The Best Way To Invest In Gold As A Beginner

Short Introduction To Gold

1. A Brief History On Gold

In the olden days, gold was used as jewelry and coins due to how malleable it is, as well as its glitter which makes it valuable. In addition to that due to the lack of technological advancement, it was much more difficult to mine gold which is another reason why gold is valuable.

As time goes by, gold is then used as a commodity for trade exchanges and stored away as it is seen as something that represents wealth. In the 20th century, currencies are backed by gold, and the number of currency notes that were printed out corresponds to the amount of gold that is stored in a vault of a nation.

In the modern age, currencies no longer correspond to the amount of gold held by a nation. Modern currencies are now known as fiat money which are currencies that are valued based on government regulation. However, gold is still seen as a valuable commodity.

2. Understanding The Supply And Demand Of Gold

The price of gold is determined by its supply and demand. For example, if the demand for gold increases while the supply remains constant then the price of gold would increase (The supply for gold is relatively fixed due to the fact that it is hard to mine them).

Typically, the demand for gold in the jewelry industry would remain fairly consistent throughout the year, depending on the market conditions the demand for jewelry may fall as well. For example, the occurrence of an economic crisis or the falling of job employment.

On the other hand, the demand for gold as an investment vehicle may vary a lot depending on the current market conditions and the overall market sentiment of gold at a point in time. Typically, during times of economic uncertainty, the demand for gold would increase due to the fact that it is perceived as a ”safe haven”.

If you are interested in tracking the current price of gold you can simply visit a website called Goldprice.org.

3. The Different Industries That Demands Gold

The Jewelry Industry

Even to this day, gold is still used as jewelry and the jewelry industry represents the largest source of demand for gold. Accounting for 50% of its total demand.

Investment

Based on the current market conditions the demand for gold investment may vary. However, gold is often seen as a ”safe haven” investment where it used to hedge against market downturns.

Aside from protecting an investment portfolio gold is also seen as an investment that will enhance an investment portfolio, reduce the volatility of an investment portfolio, and protect the purchasing power of an investment portfolio.

Application In Various Industries

Aside from its use as jewelry due to its luster, gold has other unique properties that are useful to other industries. Gold is used in the electronic industry to produce electronic circuits due to its ability to conduct electricity.

In addition to that, gold alloys are used in dentistry to produce crowns, bridges, etc due to their resistance to corrosion and stain.

4.Extracted Gold Vs Unextracted Gold

The amount of gold that is available in the market versus the amount of gold available on earth differs. As gold can also be found in seawater, but the cost of extracting them from seawater outweighs the revenue as gold is only found in small quantities when extracted from seawater.

Thus, businesses do not find it worthwhile to extract them. According to the World Gold Council estimation, about 190,000-ton metric of gold has been extracted out from the earth and about 54,000-ton metric of gold has yet to be extracted from the earth.

This means that in the coming future with the advancement of technology the supply of gold that is circulating in the market would increase.

5.What Happens To Gold During Times Of Uncertainty?

Typically, gold is valued higher during an economic downturn but there are other factors that are needed to be taken into account as well. For example, the overall market sentiment on gold, so if gold is seen as a bad investment while the economy is going through a downturn then the price of gold would fall.

However, based on the 2007-2008 global financial crises it was seen that gold was performing well in comparison to the stock market. Where the S&P500 fell 36% but the price of gold increased by 25%. One of the main reasons for the increase is due to the fact that during times of uncertainty investors would invest in gold to hedge against the downturn.

The Different Methods To Invest In Gold

In this section, we will be looking at a different number of ways you can invest in gold. Investing in gold can be divided into 2 main categories:

- Physically owned

- Non-physically owned

1. Physically Owned Gold

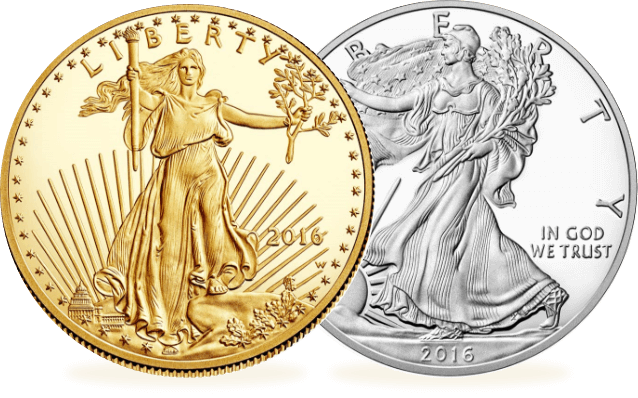

Purchasing Physical Gold (Bullion, Bars, and Coins)

If you are looking to physically own gold then this is a better method of owning them. However, do consider the cost of storing them as you need a safe to store them, and renting a safe from banks can be very costly over the long run.

Plus, if you are buying them through a middleman then the cost would be slightly marked up as well.

Purchasing Gold Jewelries

Owning gold through jewelry purchases. However, jewelry purchases are the worst way to invest in gold due to the fact that the price is highly marked up from the additional services provided by the jewelry shop.

2. Non-Physically Owned Gold

Purchasing Gold Certificates

These certificates are certificates issued out by companies that own gold. It is a certificate that claims a specified amount of gold value. It is important to note that the certificate is only as good as the company that issued them.

So, if you are going to purchase gold certificates it is better to purchase certificates that are backed by a government like certificates from Perth mint.

Purchasing Gold Futures Contract

A gold futures contract is basically an agreement to buy or sell gold on a specified date in the future. This investment vehicle is however seen as a riskier way of investing in gold especially when you are a beginner.

Investing In Gold ETFs

Exchange-traded fund or ETF is basically an investment fund that is tradeable in the stock exchange. So, a gold ETF is an investment fund that specializes in investing in gold, depending on the performance of the investment fund the stock value of the ETF would go up.

However, you do need to use a broker to trade or invest in these funds which will incur a small amount of transaction fee.

Investing In Gold Mining Stocks or ETFs

Another way to invest in gold is to invest in companies that mine them. This is a more roundabout way of investing in gold. The value of the stock is highly correlated to the price of gold as well as the performance of the company.

This means that the value of the company will go up if the price of gold increases and if the company expands its mining operations. However, this is also true the other way around. So, in cases where the company’s mining operation did not manage to mine a lot of gold and make a loss then the value of the company may fall as well.

On the other hand, if you are unsure of selecting a good gold mining company you can also choose to invest in gold mining ETFs. Gold mining ETFs are an investment fund that focuses on investing in gold mining companies. Plus, these investment funds do not just invest in gold mining companies which means that you will get a more diversified investment which is arguably safer.

Investing In Streaming Companies

Streaming or royalty companies are basically companies that invest in the development of a project or exploration of mining companies. However, with an agreement that whenever the gold mine becomes operational they have the right to purchase a percentage of their gold production at a lower price.

This means that when they sell the gold they will benefit from a high-profit margin. So, their upside is really high as even when the price of gold falls they will still profit due to their high-profit margin. So, investing in these companies is really good.

Their only downside is that if the mining project they invest in does not come into fruition then they make a loss and the price of investing in these companies is relatively higher then the rest.

It is important to note that streaming companies do not just invest gold but other commodities as well like oil&gas. This means that you would have to look into the streaming companies that you want to invest in to understand the type of commodities that they are exposed to.

Tips For Beginners

The safest way to invest in gold as a beginner is to invest in streaming companies. However, as an investor, you don’t want to put all your eggs in one basket and diversify your investment portfolio.

1. How Should I Allocate My Capital?

Although gold is a good investment, just like every other investment gold goes through a periodic downturn as well. In addition to that gold is a relatively fixed commodity due to the fact that it is hard to mine.

This means that the value of gold goes up at a very slow pace. However, over the long run gold is an amazing investment. With that being said typically you want to invest 10% of your overall portfolio into gold as a way to diversify your portfolio and hedge against times of economic uncertainty.

2. Buy Gold After A Correction Or Economic Downturn

Based on historical data from the past gold has proved itself to be a good investment in the long run. This means that over the long run the price of gold will always go up.

So, one of the best times to invest in gold is after it goes through a correction or maybe an economic downturn as the price of gold will be cheaper during those times which increases your return on investment.